By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Veterinary equipment loans provide Australian veterinary practices with funding for diagnostic equipment, surgical instruments, imaging systems, and practice technology without depleting working capital. Rates typically range from 7-13% p.a. depending on practice profile and equipment type (indicative only), with loan amounts from $5,000 to $500,000+ and terms from 1-5 years.

Most lenders require practices with active ABNs and a minimum of 12-24 months trading history, though specialist healthcare finance providers may consider newer practices. Modern comparison platforms allow efficient evaluation of options from 100+ lenders.

| Practice Profile | Indicative Rate | Typical Term | Common Equipment |

|---|---|---|---|

| Established (2+ years) | 7-10% p.a. | 3-5 years | Imaging systems, surgical equipment |

| Standard (1-2 years) | 10-12% p.a. | 1-5 years | Diagnostic equipment, practice tech |

| Newer practices | 12-13%+ p.a. | 1-3 years | Essential practice equipment |

Rates are indicative examples only. Actual rates depend on individual practice circumstances and lender assessment.

📄 Navigation Guide

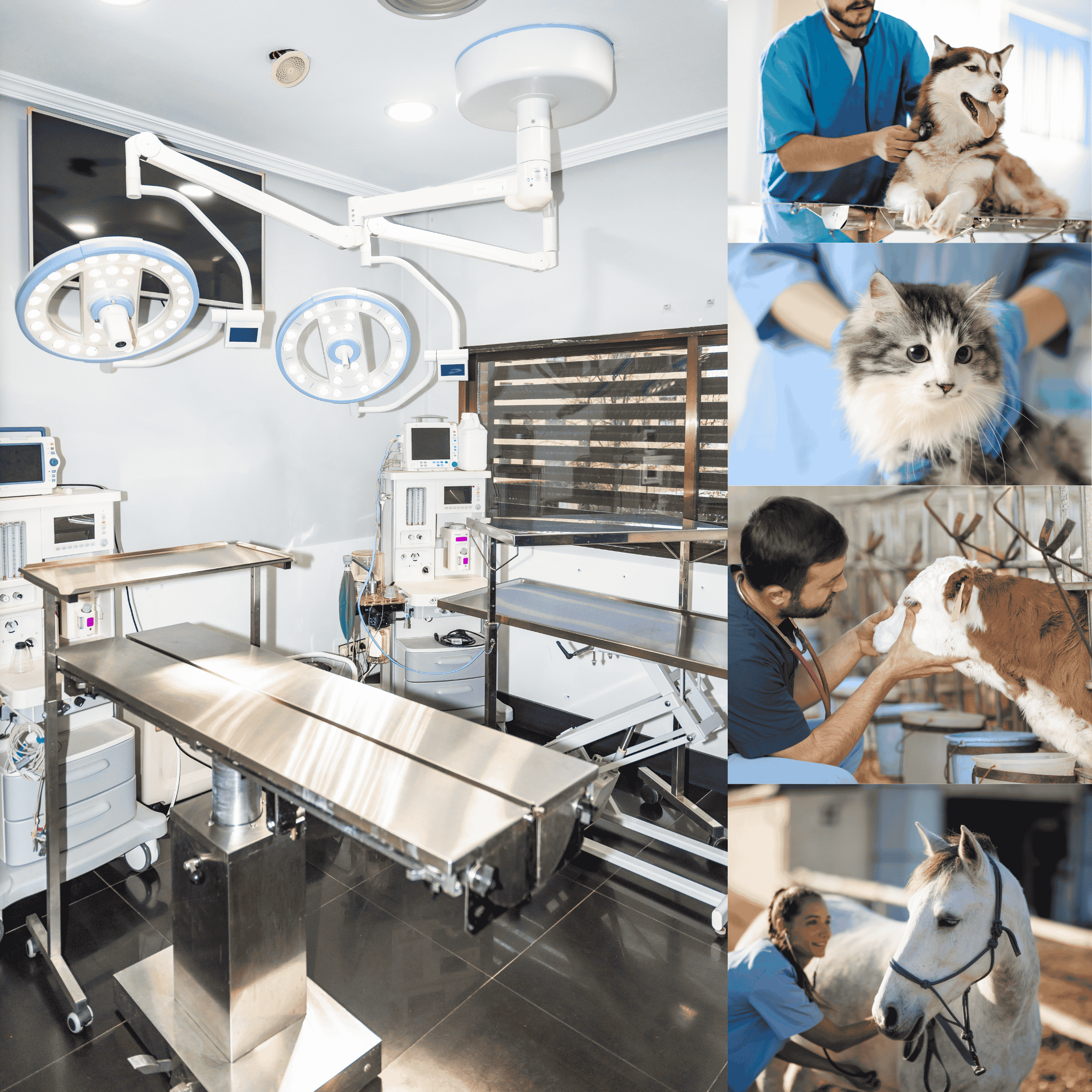

Equipment Commonly Financed

- Diagnostic Equipment: Digital X-ray systems, ultrasound machines, and laboratory analyzers.

- Surgical Equipment: Anesthesia machines, surgical tables, lighting, and sterilization units.

- Practice Technology: Practice management software and digital record systems.

- Hospital Equipment: Treatment tables, hospitalization cages, and oxygen therapy systems.

For related funding options, see our guides on medical equipment finance and dental equipment finance.

Finance Structures for Veterinary Practices

- Chattel Mortgage: The practice owns the equipment from day one, claiming depreciation and GST benefits. This is the most common structure for practices seeking ownership. Learn more about chattel mortgage benefits.

- Equipment Lease: The lender owns the equipment, and the practice makes rental payments. This is ideal for technology that requires regular upgrades.

- Commercial Hire Purchase: Ownership transfers to the practice at the end of the term.

Rates and Terms

- Indicative Rates: 7-10% p.a. for established practices, 10-12% p.a. for standard practices, and 12-13%+ p.a. for newer practices.

- Common Terms: 1-3 years for technology, 3-5 years for diagnostic and surgical equipment.

- Loan Amounts: $5,000 to $500,000+.

Eligibility for Veterinary Practices

Lenders typically require an active ABN, a minimum trading history of 12-24 months, and a clear credit history for the practice owners. Specialist healthcare lenders may offer more flexible criteria for newer practices, especially if the veterinarians have significant clinical experience.

Benefits for Veterinary Practices

- Preserve Working Capital: Fund essential equipment without depleting cash reserves.

- Tax-Effective Structures: Claim deductions for interest and depreciation (consult your accountant).

- Expand Practice Capabilities: Add new services by acquiring the latest technology sooner.

- Predictable Cash Flow: Fixed repayments make budgeting simple and predictable.

Application Process

Instead of the traditional approach of contacting multiple lenders individually, a modern comparison platform allows you to submit one application to access offers from over 100 lenders. This streamlines the process, enabling you to efficiently compare equipment finance options and find the best fit for your practice.

Frequently Asked Questions

Can I finance used veterinary equipment? Yes, both new and used equipment can be financed. Lenders prefer newer used equipment (under 3-5 years) and may require a valuation for older or more specialized assets.

What’s the approval timeframe for equipment finance? Initial credit decisions can be provided within 24-48 hours for straightforward applications. Final settlement depends on documentation and vendor coordination.

Can newer veterinary practices get equipment finance? Yes. While options may be more limited for practices trading under 12 months, specialist healthcare lenders often consider newer practices, sometimes with higher deposit requirements or rates.

Should I lease or purchase veterinary equipment? This depends on your goals. A chattel mortgage is ideal for long-term ownership and tax benefits, while a lease suits technology you plan to upgrade regularly. Compare chattel mortgage vs lease in our detailed guide.

Can I finance practice fit-outs? Yes, many lenders offer funding for practice fit-outs and renovations, often alongside equipment purchases.

Finance Your Veterinary Equipment

Ready to upgrade your practice equipment or expand your diagnostic capabilities? Loan Phone provides veterinary practices with access to over 100 lenders, including specialists in healthcare equipment finance.

Speak with Specialists

Need expert guidance on your veterinary equipment application?

Email: loans@loanphone.com.au Website: www.loanphone.com.au

Related Resources

Explore these related guides to learn more about healthcare financing options:

Disclaimer: This article provides general information only and should not be relied upon as financial or tax advice. Rates, terms, and eligibility vary by lender and individual circumstances. Tax benefits are subject to your specific situation and business structure. Always seek independent professional advice from a qualified accountant and financial adviser before making financing decisions.

Loan Phone www.loanphone.com.au | loans@loanphone.com.au

Compare Loans Now - No impact to your credit score

Last updated: October 17, 2025