By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Restaurant equipment finance provides hospitality businesses with funding options for kitchen appliances, dining furniture, and other essential assets. In Australia, rates typically range from 8-15% p.a. (indicative only), with loan amounts from $10,000 to $500,000+ and terms of 2-5 years depending on equipment type and business profile.

Modern platforms can provide fast online comparison, with settlements possible within 7-14 business days for straightforward applications. Most lenders require ABN registration, a minimum of 6 months trading history, and reasonable business financials, though specialist lenders may consider newer establishments. Potential tax benefits include depreciation deductions and GST credits on financed equipment (subject to individual circumstances).

📄 Navigation Guide

Types of Restaurant Equipment Finance Available

- Chattel Mortgage: The most popular option. You take immediate ownership of the equipment, and the lender takes a mortgage over it as security. This allows you to claim depreciation and other tax benefits from day one.

- Finance Lease: The lender owns the equipment and leases it to you for a fixed term. At the end of the lease, you have the flexibility to purchase the equipment, extend the lease, or return it. This is ideal for equipment with a high rate of technological change.

- Hire Purchase: Ownership transfers to your business after the final payment is made. This structure offers a clear path to ownership with fixed repayments.

Restaurant Equipment Eligibility Requirements

While criteria vary, most lenders will look for:

- Active ABN: Your restaurant must be a registered Australian business.

- Trading History: A minimum of 6 months of trading is often required, though some specialist lenders can assist startups.

- Business Bank Account: An account in the same name as the ABN.

- Equipment Use: The asset must be for 100% business use within the restaurant.

- Compliance: You may need to provide food handling permits or other relevant licenses.

Restaurant Equipment Finance Application Process

- Identify Equipment & Get Quotes: Finalize the equipment you need and obtain detailed quotes from suppliers.

- Research Finance Options: Use a comparison platform to evaluate different lenders and structures.

- Complete Application: Submit an online application with your business details, financials, and equipment quotes.

- Lender Assessment: The lender will review your application, a process that typically takes 3-7 business days.

- Approval & Settlement: Once approved, sign the final documents, and the lender will pay the supplier directly so you can arrange delivery.

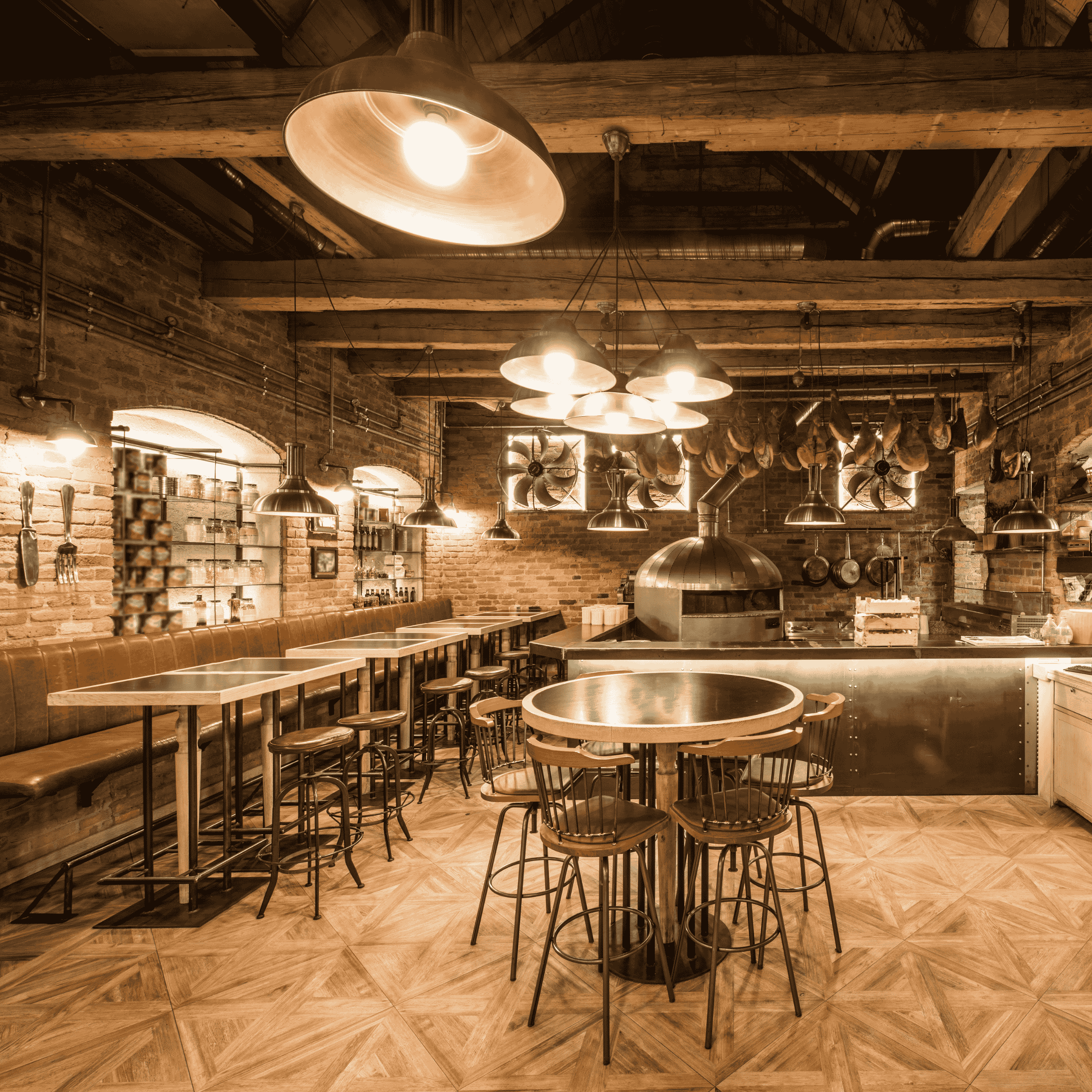

Common Equipment Financed

- Kitchen Equipment: Ovens, stoves, fryers, commercial refrigerators, and freezers.

- Dining Area Equipment: Tables, chairs, booths, and point-of-sale (POS) systems.

- Bar Equipment: Beverage dispensers, glasswashers, and under-bar refrigeration.

- Food Preparation Equipment: Commercial mixers, slicers, and food processors.

Choosing the Right Finance Option

The best structure for your restaurant depends on your goals:

- For new restaurants: You might need a lender with flexible documentation requirements.

- For managing cash flow: Consider a lease with lower monthly payments to preserve working capital.

- For long-term assets: A chattel mortgage is often best for equipment you plan to use for many years, like ovens or cold storage.

Frequently Asked Questions

What restaurant equipment can be financed? Almost any asset used in a hospitality business can be financed, including kitchen appliances, dining furniture, POS systems, bar equipment, coffee machines, commercial dishwashers, and ventilation systems.

How much deposit is required for restaurant equipment finance? Deposits typically range from 0-20%. Established restaurants with strong financials may qualify for no-deposit finance, while newer establishments might be asked to provide a 10-20% deposit, especially for used equipment.

Can I finance restaurant equipment if I have a bad credit history? Yes, it’s often possible through specialist lenders. Because the loan is secured by the equipment itself, lenders focus more on your business’s cash flow and viability than just your credit score. You should, however, expect to pay a higher interest rate.

Speak with Specialists

Ready to explore finance options for your restaurant or cafe?

Email: loans@loanphone.com.au

Website: www.loanphone.com.au

Related Resources

Explore these related guides for hospitality and business financing:

Disclaimer: This article provides general information only and should not be relied upon as financial or tax advice. Rates, terms, and eligibility vary by lender and individual circumstances. Tax benefits are subject to your specific business structure and circumstances. Always seek independent professional advice from a qualified accountant and financial adviser before making financing decisions.

| Loan Phone www.loanphone.com.au | loans@loanphone.com.au |

Compare Loans Now - No impact to your credit score

Last updated: October 19, 2025