By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Quick Answer

IT equipment finance in Australia helps businesses acquire computers, servers, software, and technology infrastructure through flexible financing options. Finance amounts typically range from $5,000 to $500,000+ with terms of 1-4 years matching technology refresh cycles. Rates generally range from 6-12% p.a. in 2025 depending on business profile and equipment type (indicative only). Both chattel mortgages and operating leases are popular for IT equipment, with operating leases particularly suited to technology requiring frequent upgrades. Modern platforms can provide fast access to technology finance suited to your business requirements (subject to lender assessment).

Navigation Guide

IT Equipment Finance Options

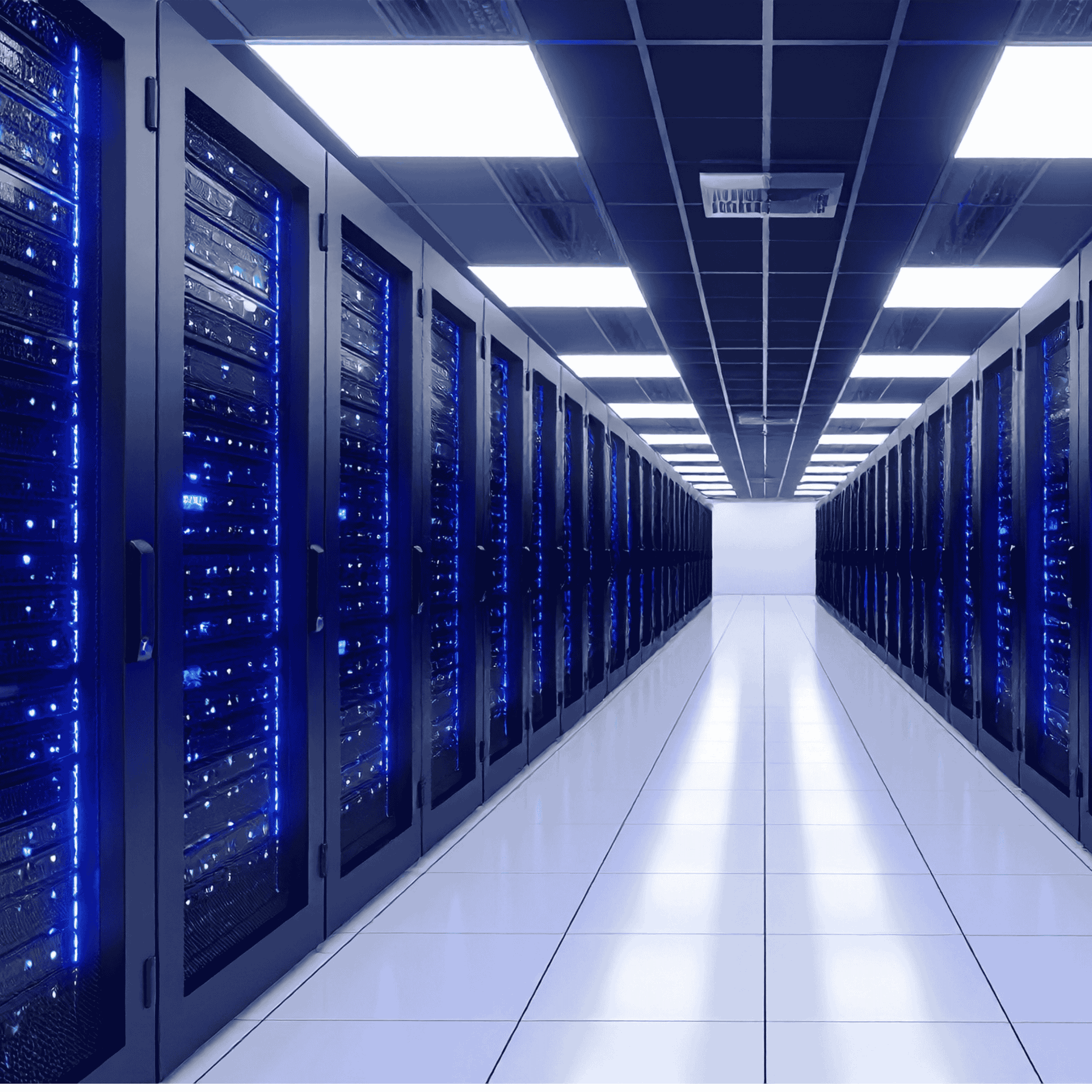

Technology infrastructure represents a significant investment for Australian businesses. IT equipment finance preserves cash flow while ensuring access to the hardware and software systems your business needs to operate competitively.

Common IT Equipment Financed:

- Desktop computers and laptops

- Servers and networking equipment

- Point-of-sale (POS) systems

- Telecommunications equipment

- Software licensing (where finance structures accommodate)

- Cloud infrastructure hardware

- Cybersecurity systems

Finance Structure Options:

- Operating Lease: The most popular structure for IT equipment given technology’s rapid evolution. You pay for equipment use over a shorter term (typically 1-3 years), then return and upgrade to current technology. Lease payments are tax-deductible as operational expenses. Suited for businesses requiring regular technology refreshes.

- Chattel Mortgage: You own the IT equipment from day one. Best suited for longer-lived technology infrastructure like servers, networking equipment, or specialized systems with 4-5+ year useful lives. GST-registered businesses (cash basis) can claim input tax credits upfront.

- Finance Lease: Medium-term arrangement with flexibility to purchase, upgrade, or return equipment at term end. Balances operational flexibility with potential ownership.

Compare technology finance structures.

Operating Lease Benefits for IT Equipment

Operating leases offer particular advantages for technology financing:

- Regular Technology Refresh: Technology equipment becomes outdated quickly. Operating leases align finance terms with technology lifecycles, allowing you to upgrade to current systems every 2-3 years without disposal concerns or obsolescence risk.

- Predictable Budgeting: Fixed monthly payments simplify IT budget planning. Some providers offer bundled maintenance and support within lease payments, creating comprehensive technology service packages.

- Capital Preservation: Lower monthly payments compared to ownership structures preserve capital for core business operations or other investments.

- Simplified Equipment Disposal: At lease end, simply return equipment. No concerns about data security, disposal costs, or remarketing outdated technology.

Explore business equipment solutions.

Eligibility and Application Process

IT equipment finance eligibility typically requires:

Business Requirements:

- Active ABN or ACN registration

- Minimum trading history (often 12 months for traditional lenders)

- Satisfactory business credit profile

- Demonstrated cash flow supporting repayments

Application Documentation:

- Business identification

- Recent financial statements or bank statements

- Equipment quotes from suppliers

- Technology specifications and usage requirements

Modern comparison platforms streamline documentation through secure digital channels, reducing administrative burden compared to traditional lending processes.

See your IT finance options now.

IT Equipment Finance Considerations

- Software Licensing: Some finance structures accommodate software licensing costs alongside hardware. Discuss software requirements with finance specialists to structure appropriate solutions.

- Scalability: Consider future growth when structuring IT finance. Some arrangements allow equipment additions during the term without renegotiating entire agreements.

- Upgrade Paths: For operating leases, understand upgrade provisions. Can you add capacity mid-term? What equipment refresh schedules are available?

- End-of-Lease Options: Review what happens at lease expiry. Are you required to return equipment in specific condition? Are purchase options available if desired?

- Data Security: When returning leased IT equipment, ensure proper data wiping procedures. Clarify responsibility for data removal—your business or the lessor.

Compare equipment finance options.

Speak with Specialists

Need expert guidance on your IT equipment finance application? Email: loans@loanphone.com.au Website: www.loanphone.com.au

Related Resources

Explore these related guides for business owners and ABN holders:

Disclaimer: This article provides general information only and should not be relied upon as financial or tax advice. Rates, terms, and eligibility vary by lender and individual circumstances. Tax benefits are subject to your specific business structure and circumstances. Always seek independent professional advice from a qualified accountant and financial adviser before making financing decisions.

Loan Phone www.loanphone.com.au | loans@loanphone.com.au

Compare Loans Now - No impact to your credit score

Last updated: 2025-10-29