The Loan Phone Blog

Your source for finance tips, industry news, and guides to help you make smarter financial decisions.

Lumi Business Loan Review - Worth It in 2026? | The Loan Phone

Lumi offers fast, unsecured business loans in Australia, typically from $5,000 to $500,000 with terms up to 24 months, ideal for working capital and smaller...

Azora Finance Review - Rates and Pros/Cons 2026 | The Loan Phone

Azora Asset Finance is a non-bank specialist lender in Australia providing flexible equipment and asset finance. This review covers their offerings, eligibility, and how they...

Truck Finance - Commercial Truck Loans Guide | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Low-Doc Equipment Loans - Approved in 24hrs | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

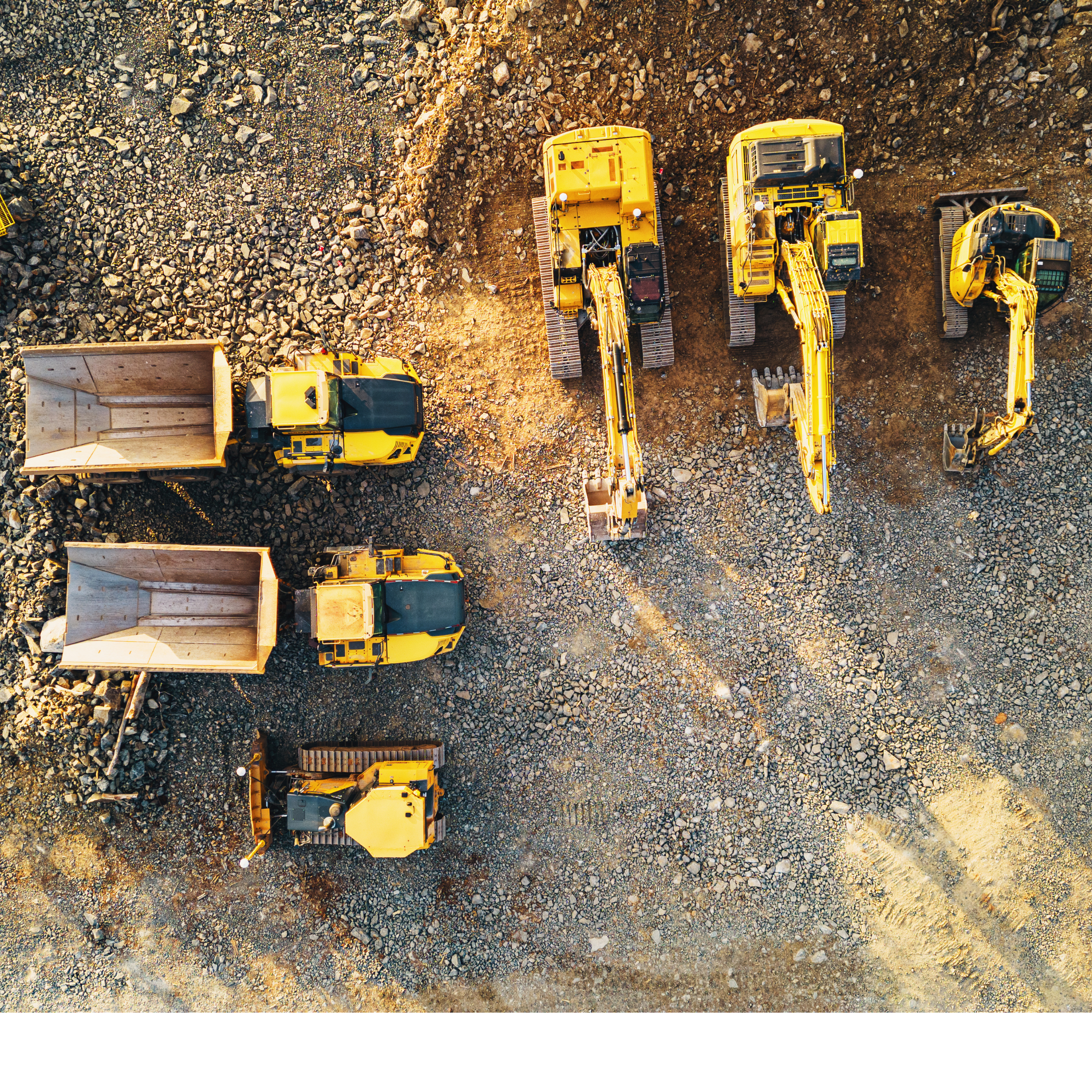

Fleet Finance - Multi-Vehicle Funding Options | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Balloon Payment Finance - Cut Your Repayments | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

2026 HiLux Finance - Best Rates for Tradies | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Commercial Vehicle Finance - Utes and Trucks | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Warehouse Equipment Finance - Compare and Save | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Equipment Refinancing - Lower Your Repayments | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Equipment Loans - How to Get Approved Fast | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking

Chattel Mortgage Lenders - 2026 Rates Compared | The Loan Phone

By the Loan Phone team Reviewed by Anthony Moncada, M.App.Fin, Cert IV Finance & Mortgage Broking